Mastering Money: Why Personal Finance is Important for Your Future

Have you ever wondered why some people seem to have their finances perfectly in order while others struggle to stay afloat? Well, the difference often boils down to personal finance , the way we manage our money, make financial decisions, and plan for the future. The importance of personal finance cannot be overemphasized. Poor financial management can be pretty stressful. According to a CNBC survey 2023, 70% of Americans felt stressed about their personal finances.

Personal finance isn’t just for the business experts or the wealthy; it’s a vital skill that everyone should master. Whether you’re just a novice on your financial journey or trying to better your money management skills, understanding personal finance can make a big difference in your life.

In this article, we’ll explore the significance of personal finance and how it can help you build a secure future. But let’s first get a wider scope of personal finance before we delve into details.

Understanding Personal Finance

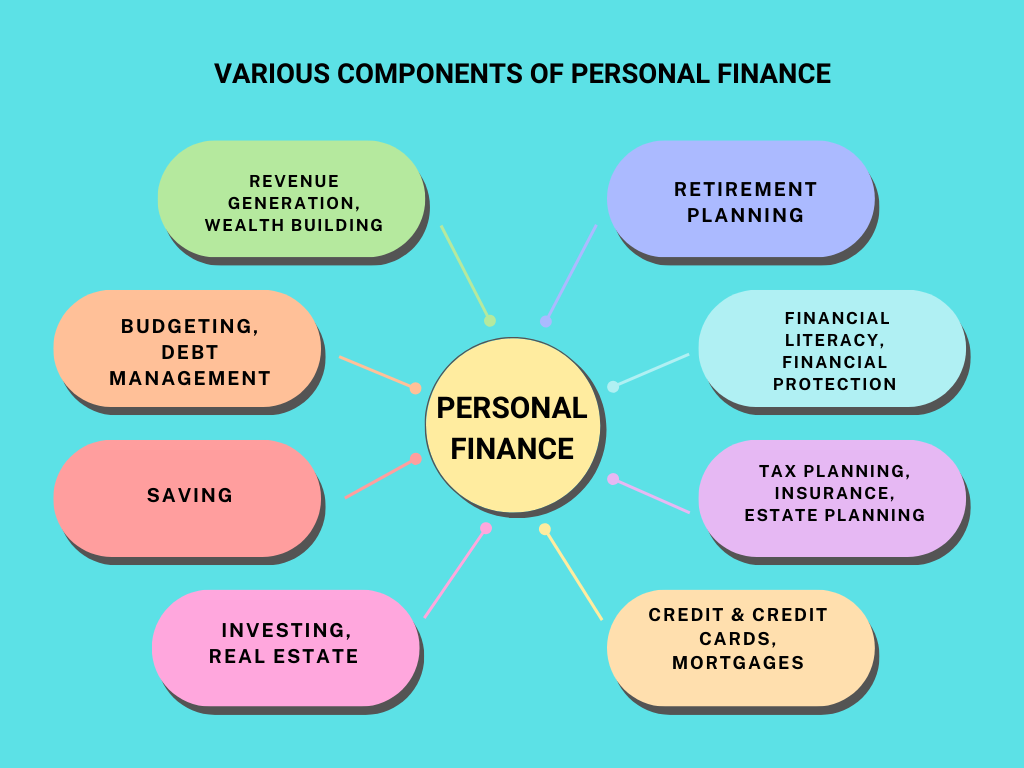

Personal finance refers to the management of your money, which includes saving, investing, and planning for the future. It covers a wide range of financial activities, including income generation, budgeting, spending, saving, investing, retirement planning, mortgaging, insurance, estate planning, banking, and tax. Personal finance also relates to the industry that offers financial services and advice to households and individuals about viable opportunities for investment.

Your personal goals and financial needs play a significant role in how you handle these aspects of your finances. Being financially knowledgeable is crucial for making the most out of your income and savings, as it helps you differentiate between sound and poor advice and enables you to make informed financial decisions.

However, most of the activities around personal finance fall under five key areas, including:

- Generating income

- Spending

- Saving

- Investing

- Protecting your future

Key Areas of Personal Finance

The following are the main areas of attention for personal finance:

Revenue

The first area of personal finance to consider is income. Income is the total amount of money that a person makes. The income may be earned through:

- Wages

- Salaries

- Dividends from stocks

- Bonuses

- Pensions

- Sale of fixed assets

- Retained profits

- Fixed Deposit accounts

- Interests from government bills and bonds

In order to manage finances, it is crucial to budget for the money generated. Setting aside money from your income for investments, savings, purchases, and expenses is known as financial planning.

Expenses

Expenses constitute the total amount of money used to pay for goods and services.

They include but not limited to the following:

- Taxes

- Loan interest

- Groceries

- Subscriptions

- House maintenance and repairs

- Entertainment

- Travel

- Credit card payments

- Rent

- Electricity bills

- Mortgage payments

An essential component of personal finance is having good expenditure management skills. Spending less than your total income is necessary for good personal financial management. Otherwise, unnecessary yet expensive debts will arise.

Savings

Savings constitute the remaining money after all expenses are subtracted from the total revenue generated. Saving can be difficult, but you should strive to save since savings come in handy in times of need and help you accomplish your objectives. You might need to reduce wasteful expenditure in order to save money. You may then keep the remaining funds as savings.

Common saving forms include:

- Money market securities, such as treasury bills and treasury bonds

- Opening a bank’s savings account

- Retaining some liquid cash for emergencies

- Insurance education saving plans

- Checking accounts

- Retirement savings

- Child trust funds

Investments

To grow your savings and increase your income, it’s essential to invest in financially sound projects. Simply keeping your money idle won’t yield any returns. Investing allows you to generate income that can outpace inflation, preserving your purchasing power. It also enables the creation of assets and fosters the growth of your wealth.

Common investment forms include:

- Real estate

- Stocks

- Mutual funds

- Commodities

- Private companies

- Fixed deposits

- Government bills and bonds

- Post office investment plans

By diversifying your investments across various financial instruments, you can build wealth beyond your initial investment. However, it’s important to approach investing with caution, as some riskier options may lead to losses.

Protection

Personal protection encompasses various products designed to shield individuals from unexpected and unfavorable situations. Key protection products typically involve:

- Estate planning, which involves preparing for the management and distribution of assets after death.

- Health insurance, which covers medical expenses and health related costs.

- Life insurance, which provides financial support to beneficiaries in the event of death.

- Property insurance, which covers loss of or damage to property

- Disability insurance, providing income replacement if you can’t work due to injury or illness.

- Liability insurance, protecting against claims of negligence or harm caused to others.

- Identity theft protection, helping monitor and recover from identity fraud or theft.

- Auto insurance, covering liability or damage connected to vehicle accidents.

Why Personal Finance is Important

1. Creating Financial Security and Stability

Imagine a scenario where your car breaks down unexpectedly. The repair bill is hefty, and you’re left scrambling to figure out how to pay for it. This is where personal finance comes in handy. The Federal Reserve’s 2022 Report on the Economic Well-Being of U.S. Households indicates that about 35% of adults said they would struggle to pay a $400 emergency expense.

Having your personal finances in order means you’re prepared for life’s uncertainties. Whether it’s an unexpected medical bill, a sudden job loss, or a global pandemic, having an emergency fund can be a lifesaver.

In the short term, personal finance is about managing your expenses to handle day-to-day needs without constantly worrying about running out of money.

Long-term financial stability is about planning for the future. Personal finance involves saving for retirement, putting money aside for your children’s education, and maybe even buying a home one day. When you understand how to deal with your finances, you don’t just survive — you set yourself up to thrive.

2. Avoiding Debt and Financial Risks

One of the biggest benefits of good personal finance management is avoiding debt. It’s all too easy to swipe a credit card for things you want now but can’t afford. But debt can quickly spiral out of control, leading to stress and financial strain.

By understanding personal finance, you can make informed decisions about when it’s prudent to borrow money and when it’s advisable to wait and save. This approach helps you avoid unnecessary debt and keeps you on track toward financial security.

Financial literacy also helps you steer clear of common financial risks. Many people find themselves in financial problems because they don’t fully understand how credit works or how to budget effectively. Educating yourself about personal finance can prevent these mistakes and set you on a path to financial wellness.

3. Achieving and Prioritizing Financial Goals

Whether it’s traveling the world, starting your own business, or simply retiring comfortably, everyone has dreams and aspirations. But without proper financial planning, these goals can remain a pipe dream. Setting and prioritizing financial goals is a critical part of personal finance as it helps you manage conflicting goals.

It’s about identifying what you want to achieve and creating a plan to get there. When you’re clear about your financial goals, personal finance allows you to prioritize your spending and savings accordingly. Maybe you want to buy a house in five years — knowing this, you can start putting money aside for a down payment.

Similarly, if you’re dreaming of taking a year off work to travel the world, having a solid saving plan can actualize that dream.

Another key element of achieving your financial goals is investing, an essential part of personal finance. By learning about different investment options and making informed choices, you can grow your wealth over time.

Investing isn’t just for the wealthy — it’s a tool that anyone can use to build financial security and work toward their goals. Retirement planning is a perfect example of why personal finance is significant. The earlier you start saving for retirement, the more time your money has to grow.

It’s easy to avoid thinking about retirement when it seems so far away, yet a little planning now can make a big difference later on. With proper personal finance management, you can ensure that you’re not working well into your golden years because you have to, but because you want to.

4. Building Wealth and Creating Financial Independence

Who doesn’t want to accumulate wealth? Personal finance is the pedestal for realizing that. It’s about making smart decisions with your money, from budgeting and saving to investing and avoiding unnecessary debt.

Over time, these small decisions add up, helping you accumulate wealth and move toward financial independence. Financial independence means different things to different people. For some, it might mean having enough money to retire early. For others, it might mean being able to work part-time while pursuing a passion project. Whatever your vision of financial independence, personal finance is the roadmap that will get you there.

Another aspect underscoring the importance of personal finance is creation of intergenerational wealth. By managing your money wisely, you can ensure that you’re not only providing for yourself but also leaving a legacy for your children and grandchildren.

Whether it’s through investments, real estate, or simply teaching the next generation about financial literacy, personal finance has the power to create lasting wealth that benefits your family for generations to come.

5. Enhancing Life Satisfaction Through Financial Freedom

Ultimately, personal finance is not just about money but also the quality of life. When your finances are in order, you’re free to focus on the things that truly matter: pursuing hobbies or spending time with loved ones. Financial security can lead to a greater sense of fulfillment and satisfaction in life.

With a firm financial foundation, you’ve the flexibility to take advantage of opportunities as they arise. Maybe you want to take a leave from work to further your education, or perhaps you’d like to explore a new career. When you’re not constantly worried about money, you’ve the freedom to make choices that improve your life.

Additionally, good financial management lets you give back to others. Whether it’s helping out a friend in need, supporting your community, or donating to charity, having your finances in order helps you make a positive impact on the world around you.

6. Credit Score Management

Personal finance helps you manage your credit score which is crucial for obtaining credit cards and loans, renting apartments, or even landing certain jobs. Good financial management enables you to live within your means through proper debt management, alleviating the urge to obtain expensive credits that might end up impacting negatively on your credit score and financial future.

Besides boosting your credit score, good credit management puts more money in your pocket through saving on your borrowing cost. You can then invest these savings to generate more wealth.

In Summary: Importance of Personal Finance to You

- It enhances your financial security and stability

- Promotes proper debt management

- It encourages savings and investment

- Helps you budget your finances to control spending

- Helps you achieve your financial goals

- Guides you to plan for your retirement

- It promotes financial independence

- It enhances your emergency preparedness

- It improves the quality of your life

- It boosts your credit score

The Bottom Line

Personal finance might not be the most exciting topic, but it’s certainly one of the most important. It’s the key to achieving your goals, financial stability, building wealth, and reducing stress. Above all, it’s about living a life where money is a tool to support your dreams and aspirations — something to have your back but not to hold you back! So start taking charge of your personal finance today .Your future self will be grateful you did.