Short-Term vs. Long-Term Disability Insurance Covers

Life is full of unexpected twists and turns, and sometimes these surprises can disrupt your ability to work. Imagine facing an illness or injury that prevents you from earning your regular income. How would you manage your bills, rent, or daily expenses? This is where disability insurance as one of the several health insurance covers comes in handy. It acts as a backup plan, ensuring you still have financial support when you can’t work due to a disability.

In this article, we’ll explore the two main types of disability insurance: short-term and long-term, and why having the right coverage is crucial for your financial well-being.

What Is Disability Insurance?

Disability insurance is a type of coverage that replaces a portion of your income if you are unable to work due to illness or injury. Think of it as a financial lifeline during challenging times when your ability to earn a living is temporarily or permanently affected.

Disability insurance is designed to cover a wide range of conditions, from temporary injuries like a broken arm to chronic illnesses or severe disabilities. It helps you maintain financial stability by ensuring you can still pay for essentials such as rent or mortgage payments, utility bills, and other expenses not covered by health insurance.

Why Disability Insurance Is Important

Many people assume disabilities are rare, but that’s far from the truth. According to statistics, one in four people will experience a disabling event before retirement age. This means that the risk is higher than you might think. Here are some reasons disability cover is essential:

- Income Protection

Your paycheck is likely your most valuable asset. Disability coverage ensures that, in the event of an injury or illness, you’ll still receive a portion of your income, allowing you to maintain your financial stability while you focus on recovery. - Avoiding Debt

Without disability coverage, you may be forced to rely on your savings, credit cards, or loans to cover daily expenses. This can quickly lead to debt, making it harder to recover financially while you’re also recovering physically. - Peace of Mind

Knowing you have financial protection in place helps you feel secure, reducing stress and allowing you to focus on getting better. With disability insurance, you can be confident that you’re prepared for the unexpected.

Imagine a construction worker who falls from a ladder and suffers a back injury. Without disability cover, this person might struggle to pay bills while recovering. With coverage, they can continue to meet their financial obligations without added stress.

Types of Disability Insurance

Disability insurance is broadly categorized into two types: short-term and long-term. Let’s explore each in detail.

Short-Term Disability Insurance

Short-term disability coverage provides coverage for a limited period, typically a few months. It is designed to replace a portion of your income while you recover from temporary conditions.

Key Features of Short-Term Disability Insurance

- Coverage Duration

Short-term disability cover typically lasts between 3 to 6 months, depending on the policy. This duration is designed to cover you during the recovery period from temporary injuries or illnesses, ensuring you’re financially supported as you heal. - Conditions Covered

STDI generally covers temporary injuries such as fractures, surgeries requiring recovery time, or short-term illnesses. This means that if you experience a health setback that keeps you from working temporarily, your insurance will help you manage financially. - Waiting Period

Benefits for short-term disability insurance often start within 1 to 14 days after you become disabled. The waiting period can vary depending on your policy, but it is the time you’ll need to wait before you begin receiving benefits. - Replacement Rate

Short-term disability policy usually covers 50% to 70% of your income. This replacement rate helps to ensure that you still have a portion of your earnings while you’re unable to work due to illness or injury.

Who Needs Short-Term Disability Insurance?

Short-term disability insurance is ideal for:

- Employees without significant savings.

- Individuals recovering from surgeries or temporary illnesses.

- Workers in jobs with physical risks, like construction or healthcare.

Long-Term Disability Insurance

Long-term disability cover is designed to provide income replacement for extended periods, sometimes lasting years or even until retirement. It’s a safeguard for severe or chronic conditions that prevent you from working for a long time.

Key Features of Long-Term Disability Insurance

- Coverage Duration

Long-term disability coverage can last for several years or until you reach retirement age. This extended duration ensures that you remain financially supported in case of a long-term or permanent disability that prevents you from working. - Conditions Covered

LTDI normally covers chronic illnesses, severe injuries, or permanent disabilities. These conditions may leave you unable to work for an extended period, making long-term disability insurance crucial for maintaining your financial well-being. - Waiting Period

The waiting period for long-term disability insurance typically ranges from 90 to 180 days. This is the time you’ll need to wait before receiving benefits after becoming disabled, often following the expiration of short-term disability coverage. - Replacement Rate

Long-term disability cover generally covers 50% to 60% of your income. Although this may be less than your full paycheck, it helps you meet essential expenses while you focus on managing your condition and recovery.

Who Needs Long-Term Disability Insurance?

Long-term disability policy is suitable for:

- Professionals relying on consistent income, such as doctors or teachers.

- People with families to support.

- Anyone who wants to ensure long-term financial security in case of a major disability.

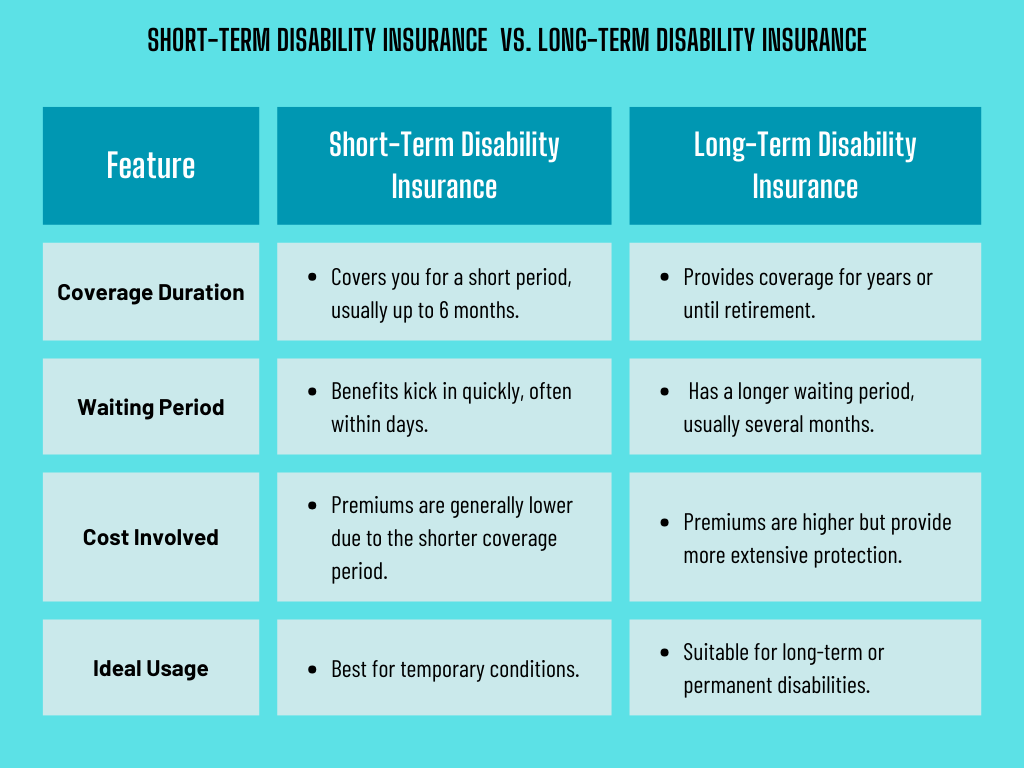

Key Differences Between Short-Term and Long-Term Disability Insurance

While both types of disability policy serve the same purpose of income protection, they differ in several ways:

Coverage Duration

- Short-Term Disability Insurance: Covers you for a short period, usually up to 6 months.

- Long-Term Disability Insurance: Provides coverage for years or until you reach retirement age.

Waiting Period

- Short-Term Disability Insurance: Benefits kick in quickly, often within days.

- Long-Term Disability Insurance: Has a longer waiting period, usually several months.

Cost Implication

- Short-Term Disability Insurance: Premiums are generally lower due to the shorter coverage period.

- Long-Term Disability Insurance: Premiums are higher but provide more extensive protection.

Ideal Usage

- Short-Term Disability Coverage: Best for temporary conditions.

- Long-Term Disability Coverage: Suitable for long-term or permanent disabilities.

In summary, below is a table of the key differences between short-term disability insurance and long-term disability insurance:

How to Choose the Right Disability Insurance

Selecting the right type of disability cover depends on your financial situation, lifestyle, and career. Here are some factors to consider:

1. Evaluate Your Financial Needs

Consider whether you have savings to cover short-term emergencies and how long you could manage without a paycheck. These factors will help you determine the level of coverage you need to maintain your financial stability during a disability.

2. Assess Your Risks

Think about the nature of your job, especially if it involves high-risk activities. Certain occupations may require more coverage due to a higher likelihood of injury. Additionally, consider your health and family medical history, as these can also affect your risk of becoming disabled.

3. Understand Policy Terms

Look for essential details like coverage limits, waiting periods, and conditions covered by the policy. It’s also important to check for exclusions, which may affect your eligibility to file a claim, ensuring you’re fully aware of what’s covered and what’s not.

4. Employer Benefits

Many employers offer group disability insurance as part of their benefits package. Be sure to understand what is included in your employer’s plan and assess whether it provides sufficient coverage for your specific needs.

5. Supplement with Individual Policies

If your employer’s coverage is limited or doesn’t meet your needs, consider purchasing an individual policy. This additional coverage can offer greater protection and fill any gaps left by your employer’s plan.

Common Myths About Disability Insurance

There are many misconceptions about disability coverage that prevent people from getting the coverage they need. Let’s debunk some of the most common myths:

“I don’t need it because I’m healthy”

Even healthy individuals can face unexpected injuries or illnesses that may leave them unable to work. Disability policy provides protection against the unforeseen, ensuring you’re covered when life takes an unexpected turn.

“It’s too expensive”

While the cost of disability cover may seem high, it’s often much lower than the financial burden of losing your income. The peace of mind that comes with knowing you’re covered is worth the investment.

“My savings will cover me”

Most people’s savings would not last long without regular income, especially in the event of a long-term disability. Disability coverage acts as a reliable backup to help you maintain your financial stability during such times.

The Bottom Line: Protecting Your Income

Disability insurance is not just a fallback option; it’s a critical component of a comprehensive financial plan. Whether you choose short-term or long-term coverage, having protection ensures that you and your family can maintain financial stability during unexpected challenges.

Don’t wait until it’s too late. Assess your needs, review your options, and invest in the right disability cover today. It’s a decision that could make all the difference in securing your future.