Differences Between Syndication, Crowdfunding, and Partnerships in Real Estate Financing

There are several ways to pool resources with others to fund a real estate project, including syndication, crowdfunding, and partnerships. Understanding the differences between these financing options is key to making the right decision. Each option offers unique benefits. However, they differ significantly, affecting your involvement, returns, and level of control. Let’s break down these financing options so you can make an informed choice.

1. Syndication

- Structure: In a real estate syndication, a syndicator (sponsor) is usually involved. A syndicator organizes the deal, finds the property, and manages the investment. The investors provide the capital but typically have a passive role.

- Investor Involvement: Investors in a syndication are largely hands-off. They trust the syndicator to make all decisions related to the property and investment.

- Management: The syndicator takes care of operations, from property management to selling the property, while investors receive returns based on the profit share and their investment amount.

- Return: Returns are usually fixed or split based on predetermined terms (usually a percentage of profits after operational expenses).

2. Crowdfunding

- Structure: Crowdfunding involves raising small amounts of money from a large number of individuals, often through an online platform, to fund a project. This can be for real estate, but also other types of investments.

- Investor Involvement: Like syndication, crowdfunding investors are passive; however, the investment is often smaller and made through a platform that facilitates the process.

- Management: A platform or sponsor typically manages the property or project, and investors receive updates through the platform.

- Return: Crowdfunding returns can vary depending on the platform and project, with some platforms offering equity stakes and others offering fixed interest payments.

3. Partnerships/Joint Ventures

- Structure: A partnership or joint venture is a collaborative arrangement where two or more parties come together to pool resources for a specific project. One partner may provide capital, while the other provides expertise, property management, or operational involvement.

- Investor Involvement: Investors in partnerships/joint ventures may be active or passive depending on the terms. Typically, both parties have a say in how the project is managed and decisions are made.

- Management: Management is shared among the partners. This means the operational responsibilities, decision-making, and risk management are more collaborative than in syndication or crowdfunding.

- Return: The returns in a partnership or joint venture are typically negotiated based on the level of involvement, expertise, and capital provided by each party.

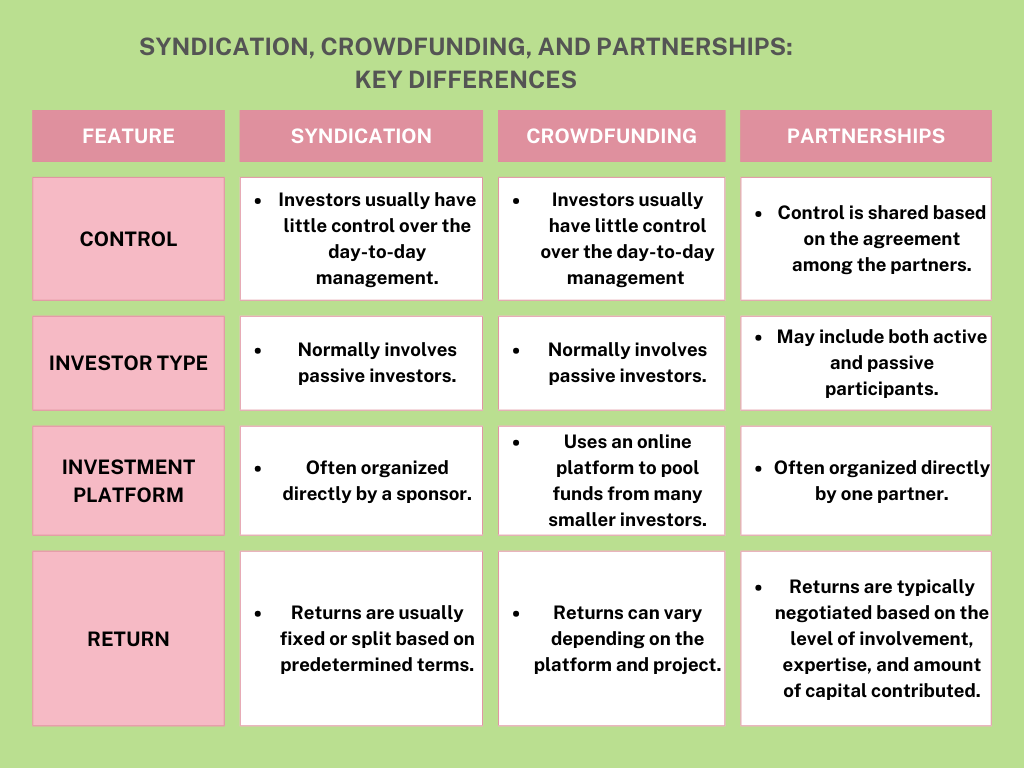

Syndication, Crowdfunding, and Partnerships: Key Differences

- Control: In syndications and crowdfunding, investors usually have little control over the day-to-day management. In partnerships/joint ventures, control is shared based on the agreement.

- Investor Type: Syndication and crowdfunding normally involve passive investors, while partnerships/joint ventures may include both active and passive participants.

- Investment Platform: Crowdfunding uses an online platform to pool funds from many smaller investors, whereas syndications and partnerships are often organized directly by a sponsor or one partner.

Below is a table summarizing the key differences between syndication, crowdfunding, and partnerships/joint ventures:

Conclusion

When it comes to real estate investing, you don’t always have to walk alone. Pooling resources with like-minded investors gets you there. Choosing between syndication, crowdfunding, or partnerships/joint ventures finally boils down to how involved you want to be and what kind of return you expect. Syndication and crowdfunding offer more passive options where others handle the heavy lifting, while partnerships and joint ventures allow for more collaboration and control. Understanding these differences can help you select the right investment strategy for your goals and experience level.